Puerto Rico's Bonds Overshadow Pension Fund Poised to Go Broke

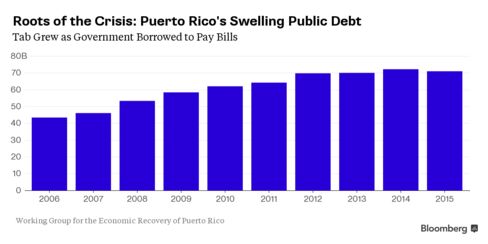

Puerto Rico’s $72 billion debt burden overshadows another financial threat to the Caribbean island: a government workers pension fund that’s set to go broke in five years.

As Governor Alejandro Garcia Padilla prepares to push for bondholders to renegotiate debts he says the commonwealth can’t afford, he’s also contending with an estimated $30 billion shortfall in the Employees Retirement System. The pension, which covers 119,975 employees, as of June 2014 had just 0.7 percent of the assets needed to pay all the benefits that had been promised, a level unheard of among U.S. states.

If not fixed, the depleted fund could jeopardize a fiscal recovery by foisting soaring bills onto the cash-strapped government even if investors agree to reduce the island’s debt. The system is poised to run out of money by 2020, which would leave the government on the hook for more than $2 billion in benefit payments the next year alone, according to Moody’s Investor’s Service. That’s equal to about one-fourth of this year’s general-fund revenue.

“As Puerto Rico shoulders that burden of paying for pension benefits outright, that’s obviously going to cripple their budget,” said Ted Hampton, a Moody’s analyst in New York.

Crisis Builds

The debt crisis gripping the island, with a population of 3.5 million, is the outcome of years of borrowing to pay bills while the economy stumbled and residents left for the U.S. mainland. In August, Puerto Rico defaulted on some bonds for the first time, and Garcia Padilla has said that reducing its debt is crucial to the island’s economic recovery.

His administration and outside advisers on Sept. 9 released a plan to repair the island’s finances, which included closing schools and reducing benefits to the poor. It also envisions making increased pension payments that have been delayed because the government hasn’t had the money.

“We believe this plan addresses the system’s needs and assures pensioners and participants that their benefits will be paid,” Pedro Ortiz Cortes, administrator for the retirement system, said in an e-mail Thursday.

Workers’ Doubts

Puerto Rico’s failure so far to address its long-building pension shortfall has fostered anxiety among workers, who are concerned that their benefits will be reduced amid competing demands from creditors. “A reduction in benefits would be horrible," said Eduard Rodriguez Santiago, a 38-year old firefighter. “Things are getting more expensive."

Garcia Padilla, in a speech after the release of the fiscal plan, said that workers have already sacrificed enough. In 2013, the government raised the retirement age, increased employee contributions and reduced or eliminated retiree bonuses.

“Solving the pension problem is almost tougher than debt because people will take to the streets if you start seeing pension checks quit going out,” said Tom Schuette, co-head of credit research at Solana Beach, California-based Gurtin Fixed Income Management LLC, which manages $9.6 billion of municipal securities. “It’s almost much easier to anger investors on the mainland as opposed to residents who can vote you out of office.”

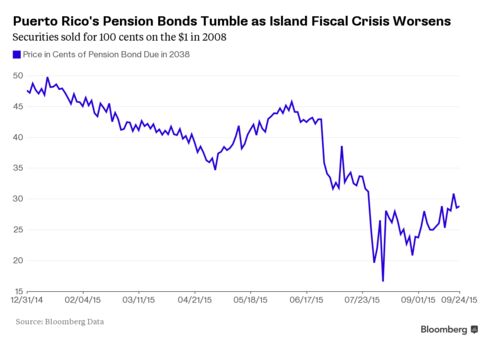

Current and prior administrations have implemented changes to improve the pension system, including by closing it to new employees and offering them annuities instead. To give it cash to invest, it sold $2.9 billion of bonds in 2008, just before the credit crisis caused stock prices to tumble. The system’s now obligated to repay the securities.

Prices on pension bonds

As Puerto Rico has cut the number of workers on its payrolls, there are fewer paying into the retirement system. The island had 116,000 central-government employees in May 2015, down 27 percent from seven years earlier, according to the report by the government and its advisers.

While new employees haven’t been eligible for traditional fixed-benefit pensions since 2000, the step didn’t stop Puerto Rico’s growing liabilities. The new employees, called System 2000 participants, will receive an annuity instead. Their contributions are being used by the pension system to meet its obligations.

New Liabilities

“They’re using these payments to shore up their existing defined-benefit plan,” said Hampton, the Moody’s analyst. “Their defined-contribution plan isn’t really taking hold. It’s just creating new liabilities for the central government.”

Puerto Rico is facing more immediate concerns because it may be short of cash as soon as November. That may leave it forced to choose between paying workers and retirees or bondholders, with $357 million of interest on its general obligations due Jan. 1.

“If the government has to decide between making a big general-obligation payment in January or making sure they have enough for payroll or for pensioners in December, I think they’re going to go with the pensioners or payroll,” Sergio Marxuach, public-policy director at the Center for a New Economy, a research group in San Juan. “You’re not going to send government workers home without money during Christmastime.”

Michelle Kaske Puerto Rico's Bonds Overshadow Pension Fund Poised to Go Broke

Comments