Puerto Rico Bill Said to Have Investor Cram-Down Mechanism

An emerging U.S. House Republican bill to address Puerto Rico’s debt crisis would create a strong oversight board and a mechanism to force creditors to accept a restructuring deal, according to a congressional official familiar with the legislative efforts and a written summary.

The board’s debt restructuring powers could include all creditors, but only after certain conditions are met, a congressional official said.

The partial draft also provides for the board to petition a judge for a court-supervised restructuring, which would amount to a cram-down mechanism to force resistant investors to accept a deal, according to a Republican-drafted legislative summary circulated Thursday on Capitol Hill and the congressional official.

The proposal would be an alternative to a process under Chapter 9 of the U.S. bankruptcy code, which Republicans have opposed.

As part of the plan, lawmakers are also considering safeguarding Puerto Rico from legal action by temporarily prohibiting creditor lawsuits.

The proposal, which is being developed by Republicans on the House Natural Resources Committee, remains fluid and details could still change, congressional aides said Thursday.

A legislative hearing on the proposal is planned for April 13, after the House returns from a recess.

Oversight Board

The oversight board included in the draft is modeled after the one imposed once on the District of Columbia, rather than on the one proposed by the U.S. Treasury Department to address Puerto Rico’s financial troubles, the congressional official said.

The board would consist of five appointed members and would have the power to hire financial and management experts, according to the summary.

Forcing creditors into a restructuring if Puerto Rico fails to negotiate in good faith would be “an extreme stand,” said Daniel Solender, who manages $18 billion of state and local debt, including commonwealth securities, as head of municipals at Lord Abbett & Co. in Jersey City, New Jersey.

“The outcome is definitely uncertain in that type of structure,” Solender said. “It’s concerning how everything will be decided and who would be deciding.”

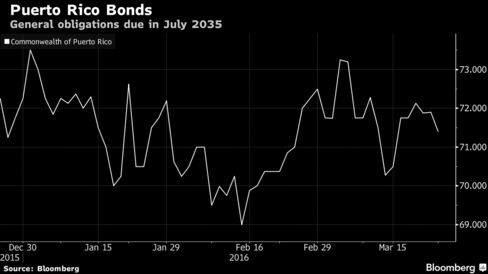

Prices on Puerto Rico securities were little changed Thursday. General-obligations with an 8 percent coupon and maturing July 2035 traded at an average price of 71.25 cents on the dollar, compared with 71.5 cents the day before, data compiled by Bloomberg show. The average yield was 11.8 percent.

Lawmakers may alter the legislation as it makes its way through the House and the Senate, potentially weakening any proposed forced restructuring, Daniel Hanson, an analyst at Height Securities, a Washington-based broker dealer, wrote in a report Thursday.

“We continue to believe that a federal control board created by such a law would have expansive authority over local Puerto Rico budgets but limited ability to coerce creditors into any kind of restructuring,” Hanson said in his report. “Any bankruptcy authority passed through Congress will likely include only limited scope.”

Democrats have been told by Republicans drafting the bill that a version of the measure is to be publicly posted on March 29, said a Democratic aide.

Tight Timing

But time is running tight. Governor Alejandro Garcia Padilla has warned the island may default May 1 on a $422 million debt payment unless the commonwealth reaches an agreement with its creditors. Puerto Rico and its agencies face another $2 billion payment due July 1.

“At least people are working toward a solution, so that’s a positive thing,” Solender said. “The structure is uncertain, but at least there’s progress in that direction.”

Republicans have in recent months been insisting that Puerto Rico needs a strong oversight board to manage the territory’s fiscal problems. By modeling such a board after the one imposed on D.C. in the 1990s, Republicans are choosing a muscular body that could likely limit the powers of officials in Puerto Rico.

The federal government in 1995 established a five-member control board to oversee the District of Columbia’s finances and imposed a chief financial officer to manage the district’s agencies. The panel had the power to override decisions by the mayor and the D.C. city council.

That control board ended its oversight in 2001 after four straight years of balanced budgets and approved audits.

Several Hurdles

Under the plan being shaped now by House Republicans for Puerto Rico, such a board would seek audited financial statements at all levels of government, the legislative summary said. The board also would have the authority to enact budgets if the governor and lawmakers do not, and make cuts in departments and agencies, including public corporations.

Certain conditions would have to be met before the board could proceed with debt restructuring, including audited financial statements, a fiscal plan and budget, and mediation among the various debtors and creditors.

As a last resort, according to the memo, the oversight board would have the power to authorize a petition in U.S. District Court for restructuring.

Also mentioned in the summary is that an independent study would be conducted of Puerto Rico’s pension obligations and their sustainability.

Puerto Rico Bill Said to Have Investor Cram-Down Mechanism

Comments